Preparing for 2023

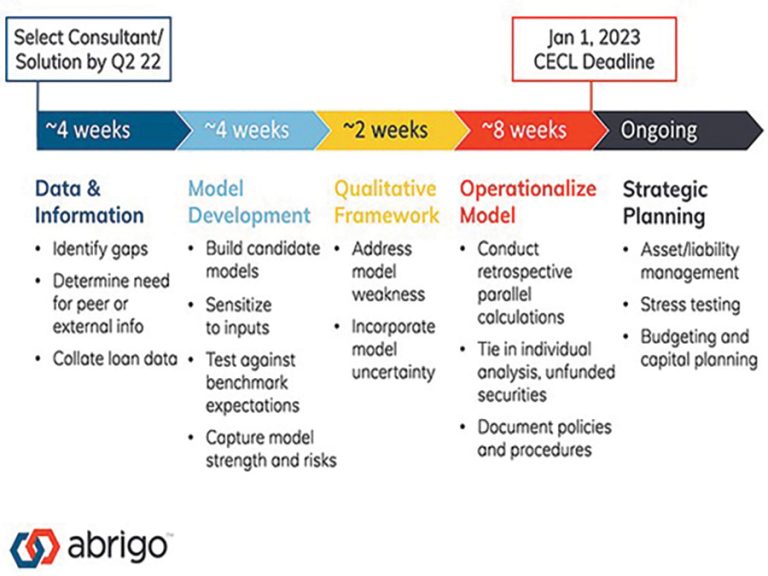

Community banks have a 2023 deadline for CECL implementation, leaving limited time to refine their processes. This timeline will help plan the transition.

“The time is now” for CECL implementation

Large SEC filers have officially adopted the current expected credit loss standard, or CECL, for recognizing credit losses, and other financial institutions are eager to learn from their CECL implementation efforts. While community banks have until 2023 until they must comply with CECL, many institutions were caught up in “analysis paralysis” in their transition, delaying their preparations. Add a global pandemic to the mix, and CECL implementation has been on the back burner for many financial institutions. Experts and 2020 adopters have repeatedly stressed the importance of preparing early. “If you’ve kind of been dragging your feet on this, now is the time,” said Brandon Quinones, Director of Client Education at Abrigo. “The bottom line is, there are no benefits to starting early, because it is no longer early. The time is now to ensure you are ready for Jan. 1, 2023.”

Preparing for CECL implementation

During Abrigo’s CECL Kickstart webinar, Garver Moore, Managing Director of Abrigo Advisory Services, discussed strategies for financial institutions’ CECL implementation in 2023, including:

- How to address the most common CECL implementation problems, such as lack of historical loss experience or unreliable historical data

- How to use CECL models that are less reliant on historical, loan-level loss experience

- How to implement a straightforward CECL qualitative framework

- How to credibly identify peer institutions for the use of external information

Community banks just starting their transition to CECL should consider possible partnerships and begin assessing data gaps and accuracy. Leveraging a third-party vendor to assist with CECL can be highly beneficial in the CECL transition, but finding the right vendor is paramount. “You want to avoid ‘black box’ solutions,” explained Quinones. “CECL is all about the data that you have available and the way that you use that data. So, if you’re just putting it all into a ‘box’ that’s just spitting out an answer, and you can’t actually go in and identify where those numbers are coming from, then you put yourself in a difficult position to defend your calculations with examiners.”

When completing vendor due diligence, ensure that the solution is transparent and can be easily communicated with examiners, including the need for user-driven changes and a simplified data integration process. Community banks will need to test and compare different methodologies to determine the right one for their loan portfolio, so it’s critical a third-party solution has the ability to run multiple scenarios concurrently, which is key for modeling decision-making. Once the community bank selects a vendor, it should ensure that clear timelines and action plans have been communicated and are in place.

Determining whether their data is accurate and thorough enough to estimate future losses can be a struggle for some community banks. Thankfully, there are flexible options available depending on the type of data available to your institution.

“The standard gives you a lot of options on how to estimate future credit losses,” said Moore. “And those different options have different data requirements, including the amount of data you need, how far back it goes, and what that data covers. Yet, even if you have data, that doesn’t mean that you have intelligence. If you have 15 years of granular data as a small commercial bank, there might not be a material loss in that entire dataset, which wouldn’t tell you anything meaningful.”

If a community bank finds that it lacks data, has inaccurate data, or struggles with data gaps, it will likely need to make assumptions based on peer or industry data. For a successful CECL implementation and to satisfy examiners, assessing the community bank’s data situation is a critical first step.

Methodology choice is vital in CECL implementation. Data availability should guide a community bank’s decision to leverage a particular methodology or methodologies. “It’s important to dispel the myth of, ‘I need to just try every option on every loan type,’ especially when it doesn’t map out to what the institution does,” advises Moore. While considering various scenarios is generally a good idea, there is no expectation to model every possible permutation. For example, some methodologies, like vintage analysis, can be ruled out quickly because the institution’s data is simply insufficient, and discounted cash flow or remaining life would be a better approach.

Regardless of the community bank’s methodologies, documenting the decision is critical. Not every methodology will work for a financial institution’s unique circumstances, and there will likely be significant back and forth during CECL committee discussions before a community bank determines the direction it wants to go in. Examiners, however, will lack the context of the discussions and strategies unless these processes are well-documented. Community banks must ensure examiners understand why the institution ultimately decided on its chosen methodology.

Testing, discussing, and deciding do not happen overnight. Community banks must devote enough time to each area for successful CECL implementation.

CECL implementation stages for 2022

Based on the timeline graphic above, here are four stages of CECL implementation prep your institution can follow to stay on track before the 2023 deadline.

1. Data and Information

Four weeks into Q2 of 2022, institutions should ideally have selected a consultant or solution, identified gaps in their data, and determined a need for peer or external information. The good news for 2023 CECL adopters is that no set amount of data is required to produce a meaningful projection of future losses. Different amounts of data are necessary for different CECL methodologies, and a certain amount of data, in an information sense, is required to estimate likely defaults or losses in different economic environments. Learn more about efficient data and information assessment in the first webinar in the CECL Streamlined series.

2. Model Development

After data collating, your institution should be building candidate models, sensitizing to inputs, and testing against benchmark expectations. Many financial institutions adopting CECL decide that external information is required to construct a meaningful estimate for at least one material portfolio segment. However, peer selection without a way to determine likely measurement outcomes can lead to unpleasant surprises and do-overs, creating awkward decision trails to explain. Join a peer selection webinar to review best practices for identifying potential peer institutions for your estimation and discuss some “worst practices” to avoid during CECL implementation.

3. Qualitative Framework

At this stage, your institution should address model weaknesses and incorporate model uncertainty. Weaknesses vary, so prepare your institution for calibrating the historical loss basis, whether peer-based or based on internal experience, to anticipated economic conditions and projecting those same conditions.

4. Operationalize Model

In the final stage of this CECL implementation timeline, institutions should conduct retrospective parallel calculations and sensitivity tests in different environments. Financial institutions should understand how uncertainty about the future provides an important lever to calibrate allowance results and how that uncertainty can be used to establish a ‘baseline’ of allocation.

As the 2023 deadline becomes less distant, community banks will need to devote a significant amount of time and resources to their CECL processes. But with organization, determination, and expert assistance, they can build a credible and efficient model, overcome roadblocks, and stay on time.

Takeaway 1

“Analysis paralysis” and the pandemic put CECL implementation on the backburner for many CFIs.

Takeaway 2

CFIs getting started with CECL should consider possible partnerships and assess their data.

Takeaway 3

In 2022, consistency is key. Each quarter represents an opportunity to make progress on CECL implementation.

Kate Stoneburner is a Content Marketing Manager at Abrigo, where she works with industry thought leaders to create digital content that helps financial institutions better serve their customers. Before joining Abrigo, Kate managed social media and produced articles for Campbell University’s quarterly magazine and other university content initiatives. She earned her bachelor’s degree in strategic communication and professional writing from Miami University.