There are many advantages to the SBA 504 loan program that can provide you with a competitive advantage and provide the best financing for your small business client. The SBA 504 loan program combines financing from a bank or other financial institution with financing from the SBA to allow for up to 90% financing on commercial real estate. The real estate must be 51% or more occupied by a small business operating company that is the borrower or guarantor on the loan.

Key benefits include lower effective interest rates, long-term financing and fully fixed interest rates, with July 2024 rates as low as 6.206%. This program can help offer small business clients a lower effective interest rate compared to conventional or SBA 7(a) rates, particularly useful in a competitive financing environment.

Lower Effective Interest Rates

- Many borrowers are rate sensitive as rates have increased from 2020 and 2021 levels.

- In addition, for many owner-occupied commercial real estate financing requests, there can be several financial institutions competing for the same deal.

- Using the 504 loan program may help you offer the small business client a lower effective interest rate than your institution’s conventional or SBA 7(a) rates would allow for.

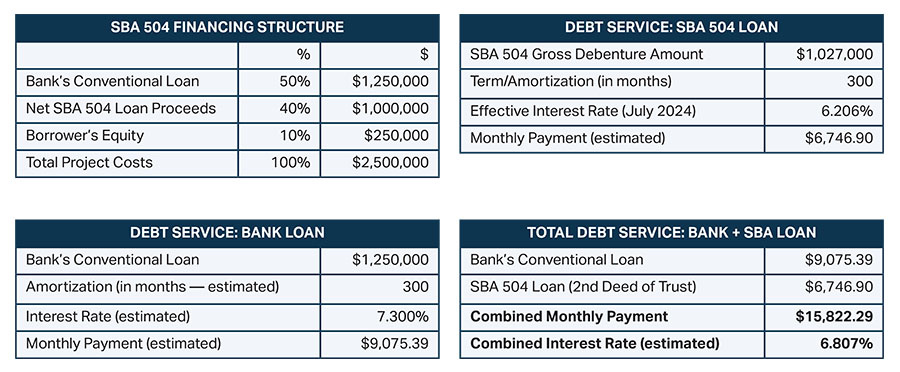

For example, let’s say your institution can offer an interest rate of 7.30% for owner occupied commercial real estate. Considering a property purchase price of $2,500,000, your loan to the borrower would be $1,250,000 at 7.30%. The SBA 504 loan would be $1,000,000, assuming 10% equity of $250,000. After SBA fees, the gross SBA 504 loan will be $1,027,000.

If you use the SBA 504 loan program, you can offer the client an overall effective interest rate of 6.807%.

SBA 504 Project Example

Fixed Interest Rate

- The 504 portion of financing has a fixed interest rate for the entire, fully amortizing term.

- The interest rate never changes on the 504 portion.

- This fixed rate provides payment certainty for the small business owner.

Longer Repayment Terms

- The 504 loan program can offer a loan term up to 25 years. A 20-year or 10-year SBA 504 loan are other options.

- The bank portion of the financing typically has an amortization matching the 504 term/amortization, but can have a term as short as 10 years.

- Longer repayment terms mean lower monthly payments, which can improve cash flow and reduce the overall cost of borrowing. By spreading the loan payments over a more extended period, the effective interest rate becomes lower, easing the financial burden on small business owners.

Want to compare if the SBA 504 or 7(a) loan is the best fit for your borrower? Check out our recent B:Side University Session at www.bsidecapital.org/training-resources.

Jessica Stutz is the lending director at B:Side Capital, a Denver-based, mission-driven organization dedicated to the success of small businesses, leveraging decades of experience, expertise and a commitment to excellence. Her daily joy is working with an amazing team of SBA experts who provide access to SBA capital. B:Side Capital provides SBA 504 and direct loans to small businesses in Colorado, Utah, New Mexico and Arizona, as well lender support to SBA 7(a) lenders nationwide.