Deposit flows aren’t just a reflection of customer preferences; they also drive profitability, financial stability and lending capacity. When deposits move, they can affect balance sheet growth, increase credit availability and reshape the competitive landscape. It’s therefore notable that over the past five years, historic volatility has redistributed deposits among banks, with the smallest gaining the largest share.

Deposit Growth Has Reaccelerated to a More Normalized Growth Path Following a Post‑COVID Stimulus Trough …

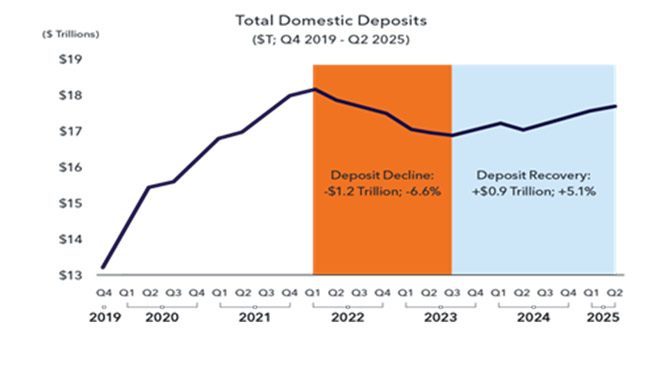

As the accompanying chart shows, total domestic deposits surged during the pandemic and then declined sharply during the Fed’s tightening cycle. In late 2024, deposits began flowing back into banks as the Fed began softening its interest rate policy. By Q2 2025, after 100 basis points of cuts to the Fed funds rate, domestic deposits had grown by roughly $900 billion.

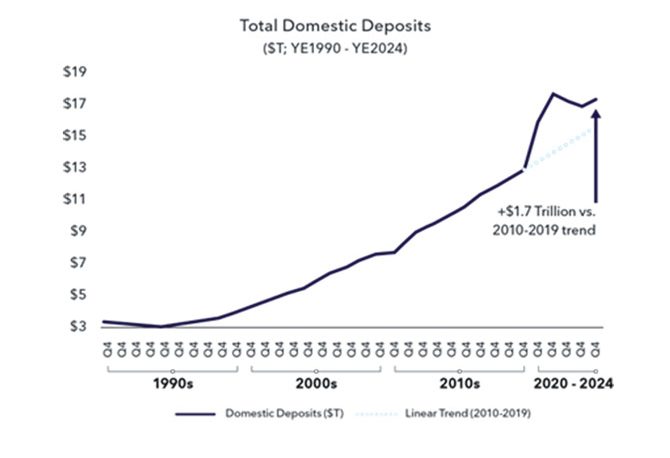

… and Is Now Tracking Historical Growth Periods, Albeit at a Higher Starting Level

This recovery has followed a stable trajectory, with a compound annual growth rate (CAGR) of approximately 3%, far more sustainable than the 16% CAGR during the pandemic and closer to the 5% CAGR seen before 2020. The aggregate deposit level has settled at $1.7 trillion above the pre-pandemic trend line.

Punching Above Their Weight: Across Recent Periods, Community Banks Outperformed Their Larger Peers …

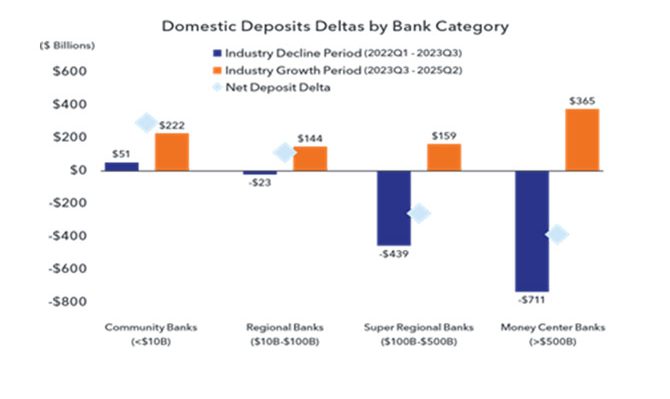

While all bank size groups have grown deposits since the Q3 2023 bottom, community banks have gained the most relative to their size on a merger-adjusted basis.

For instance, by Q2 2025, community and regional banks had fully recovered and posted net deposit gains, while super regional and money center banks had not yet regained the deposits lost during the downturn. Reciprocal deposits played a notable role in community banks’ deposit growth, representing $46 billion or 21% of their $222 billion increase during the industry growth period.

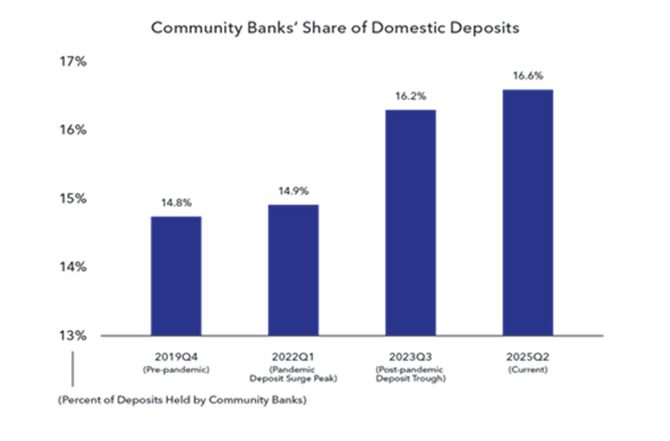

… Which Drove Increases in Community Bank Market Share

Community banks also gained market share during the decline and recovery. Before the pandemic, they held 14.8% of total domestic deposits. That share remained steady through the surge years but rose during the decline as larger banks lost ground and continued rising during the recovery. As of Q2 2025, community banks hold 16.6% of total domestic deposits.

What Explains These Results, and Where Is Deposit Growth Going?

Several factors likely contributed to the outperformance of smaller banks:

- Product Promotion: Many community banks may have promoted more competitive deposit products, such as time deposits, to a greater extent than larger institutions.

- Customer Relationships: Stronger ties with local customers may have helped them retain deposits.

- Deposit Betas: Larger banks may have customers who are more sensitive to rising rates and did not raise their rates as fast as other alternatives, such as money market mutual funds.

While these factors warrant further study, the data suggests that community banks, often assumed to be at a structural disadvantage, have proven more nimble in responding to shifting depositor behavior.

Can Community Banks Hold Their Gains?

Future outperformance isn’t a given. Larger banks could respond with aggressive pricing, digital strategies or other tactics to win back deposits. Indeed, 93% of respondents to IntraFi’s most recent quarterly survey of bank executives, the vast majority of which are community bankers, expect deposit competition to stay the same or intensify over the next 12 months.1

The institutions that come out ahead will be those attuned to how and why depositors move. Community banks, having gained ground during a period of heightened volatility, must try to sustain this momentum in a marketplace shaped by trust, convenience and evolving customer expectations.

1. Q2 2025 IntraFi Bank Executive Business Outlook Survey

Since its founding over 20 years ago, IntraFi has been chosen by over 3,000 financial institutions. IntraFi’s deposit network is the largest of its kind, and its tested, trusted services help its network members acquire high-value relationships, fund more loans and seamlessly manage liquidity needs. IntraFi invented reciprocal deposits and is the No. 1 provider of deposit placement solutions, offering the largest per-depositor, per-bank capacity.