MY CAREER

When asked to reflect on nearly 50 years of changes in banking and a few personal anecdotes, my first observation is that I’ve enjoyed a very good career: representing a great industry and terrific bankers in a turbulent political world. Most of you would hate that world; I loved it.

Bankers are special. They build communities and our state and country and exemplify CBA’s motto: Helping Coloradans Realize Dreams.

Starting at CBA in 1975 and then as CEO in 1979, I’ve spent 47 of my 71 years (2/3 of my life) at CBA, advocating for banking. I often joke about having the three most reviled professions: lawyer, lobbyist, banker. My heart is in advocating for banking.

Banking has seen a phenomenal change of pace over my 47 years. Most of it was as unpredictable as the COVID shutdown. Change will continue – at a rapid pace.

OVERVIEW

Banking is a cautious industry advocating in a public policy world dominated by change advocates; we get little sympathy and significant distrust since banking is pervasive.

I’ve seen Colorado change politically and economically; banking has had its ups and downs and endured and survived crises. The industry is now in good shape with goodwill, capital, and talent. But we’ve dealt with the good, the bad and the plain ugly. Political shifts in an increasingly caustic climate – driven by public attitudes about banks – have dealt with issues like ballot initiatives, Colorado’s in-migration, marijuana, and many other forces. Economically we’ve endured the miserable 1980s with multiple financial calamities, a residential mortgage fueled breakdown, technology’s impact, COVID’s effects, and more.

Banking’s internal changes include adopting branching and interstate banking, seeing bank numbers rise and fall and their sizes increase, watching bank management shift significantly from owner/operators to hired management – decreasing the industry’s local voice with the public and public officials – and continual shifts in technology.

PERSPECTIVE

When I started, there were NO ATMs off bank premises. No branch banks, interstate banking, price competition for deposits (government rate restrictions prompted banks to give toasters, blenders, and electric blankets as premiums). We had no telephone banking, internet banking, mobile banking, large IT and compliance departments, funds transfers by Zelle …

National economic malaise from the 1970s energy crisis produced the energy boom seeking the world’s richest oil shale deposits in northwestern Colorado (>1.5 trillion barrels of oil). That boom pulled thousands of workers to Colorado; Denver was called the “energy capital of the world.” Colorado and banking prospered, much of Denver’s skyline was built, and the Dynasty TV show documented that prosperity.

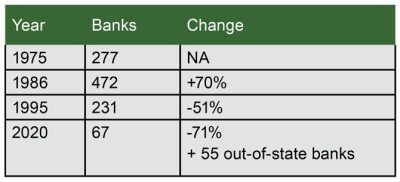

In 1975, Colorado had 277 banks; that swelled by 195 (70%) in 10 years to our peak of 472 in 1986. In 1984 alone, 46 banks were chartered in Colorado.

The disasters in 1985-1995 of the ag crisis, energy bust, real estate collapse, and S&L implosion (following deregulation of S&Ls and bank rates) and the onset of branch banking saw 241 Colorado banks disappear to 231 (-51%). Then, from 1995 to the present, further consolidation from branching, interstate banking and M&A reduced bank numbers another 164 (-71%) to today’s 67 Colorado-domiciled banks – plus the 55 out-of-state banks both large and small that do business here. Those 122 banks operate close to 1,400 branches. Over 400 banks were gone, marking a transition from hundreds of banks with dedicated markets decades ago to today’s highly competitive and consolidated industry.

Denver-based Silverado Savings became a poster child of the S&L scandal. Black Sunday, May 1982: low oil prices caused Exon to pull the plug on massive oil shale development in Western Colorado. Denver was teased nationally about “see-through” buildings. Federal Deposit Insurance Corp. Chair Bill Seidman (frequent CBA guest and speaker) also ran RTC managing huge assets from failed S&Ls and banks.

CBA held a special convention in 1985 on branching; both proponents and opponents saw branching as a key factor in their survival; both thought they would win the CBA vote. Proponents won. Starting in 1991, Colorado phased in branch banking: limited branching initially, unlimited by 1997.

In 1995 Colorado permitted interstate banking, except First Bank System (MN, now US Bank) was allowed to pay fees earlier to Colorado to partially reimburse depositors after the industrial banks, and their state guarantee fund collapsed.

A housing bubble produced the 2008 meltdown, and Congress authorized $700 billion (a huge amount then) to purchase distressed assets. Coincidentally, the Democratic National Convention was held in Denver that year.

In 2010, the Dodd/Frank Act adoption saw intense lobbying: two weeks on the floor of the Senate, 400-plus amendments, 2,319 pages. Most big congressional bills are debated for a couple of days and contain a few dozen amendments. It was a fight to anticipate, analyze, and lobby that volume.

Colorado legalized marijuana in 2012, effective 2014. A Feb. 14, 2014 international media feeding frenzy occurred at CBA when we said FinCEN’s “green light” was yellow at best, actually red for most.

Under one-party control in Colorado (for the Democrats), CBA was able to protect banking generally, but business has been beaten up badly.

Jan. 16, 2020, at the urging of the CBA, the Colorado banking board blocked a credit union purchase of a bank (the first one stopped in the U.S.). The COVID shutdown started two months later, and banks scrambled to make PPP loans. A mess at first, banks became heroes making 90% of loans, 95% of dollars for the 200,000 Colorado loans ($15B), the most completed during the first couple of weeks of the shutdown.

HIGHLIGHTS

Your CBA, I’m proud to say, has been able to deliver robust results to member banks. Our perseverance and proactivity generated an incredibly strong state government relations record with significant impact federally. Our member education and information efforts have been strong and dynamic for our changing industry.

Government relations – CBA’s reputation on state-level government relations reflects our nearly 100% success rate and stems from both successful defensive work, and instigating and advocating a long list of innovative pro-bank legislation on dozens of topics (often “first in the U.S.”). During the 40 years between 1975 and 2015, we worked on approximately 5,000 bills, and while we agreed to reasonable compromises, CBA lost only two bills in 40 years. Nationally, CBA has a reputation as an aggressive and effective lobbying force and is prominent among state bankers associations leading the fight for banking’s agenda.

We owe much of that to one attitude: CBA perseveres. We out-work and out-think the opposition; we never give up. It reflects a slogan from my childhood, “If it doesn’t fit, get a bigger hammer.”

Our industry has had many major legislative fights on foreclosure, marijuana, unclaimed property, lender liability, data privacy, fraudulent transfers, appraisals, construction defects, compliance documentation, unclaimed property, public deposits, credit unions, and more.

We also fought several ballot initiatives that plague our state. We prevailed on many, but not all. Out of dozens of expensive ballot fights, the big ones were:

- Repeated efforts to increase Colorado income taxes – always rebuffed, CBA always vigorously opposed

- Marijuana – adopted in 2012, effective 2014

- Foreclosures – against all odds, CBA prevailed on a measure to restrict foreclosures after the 2008 meltdown

- Among several dozen others, CBA killed proposals for a state-owned bank eight times (four in the Colorado Supreme Court)

Our advocacy in Washington, D.C. has involved hundreds of meetings with members of Congress, dozens in the fall of 2008 alone. CBA has made approximately 40 annual Washington visits with hundreds of bankers. I’ve made about 200 total trips to D.C., had dozens of meetings with regulators including Ben Bernanke and Janet Yellen, and members of Congress like Barney Frank and John McCain regarding hundreds of issues. I also conducted dozens of night tours of Washington, D.C. for Colorado bankers.

CBA established the Center for Bank Advocacy (beginning in 2013 and continuing today): a training practicum with 100-plus bankers completing the yearlong program to become polished banking advocates.

Public image – Through the years, we’ve reacted on media topics like failed banks, ag foreclosures, 2008 meltdown causes, home foreclosures, bank bailouts. We worked proactively to build confidence in banks; we emphasized small business lending, financial literacy, Y2K. Major media – Al Jazeera, BBC and every U.S. news network, American Banker, Wall Street Journal, Forbes, and Washington Post – have reached out to CBA.

Banker education – CBA hosted many big conferences in the 1980s when we had hundreds of banks. For years we sponsored annual conferences at the Broadmoor on commercial lending, consumer banking, mortgage lending, ag banking, trust, investment, public funds, senior management. The contrast with today’s efficient and focused meetings and Zoom calls demonstrates the industry’s transformation as today’s competitive industry emerged from prosperous banking with dedicated markets in previous times.

For example, at the big annual conventions (with approximately 1,500 attendees) in the 1980s, we had big-name entertainment and national speakers like Tom Brokaw, cabinet members, senators, governors, business leaders, and political analysts. Many correspondent bankers across the U.S. attended, as did the entire boards of directors of some member banks. We hosted sports activities and huge cookouts; annually, in the most prosperous years, the concluding dinner required two huge simultaneous receptions followed by three giant concurrent dinners.

Outreach – Until the late 1990s, we annually conducted the “Caravan” to nine Colorado towns accompanied by correspondent bankers; we provided education and social interaction with several hundred in attendance at many locations. In fact, I met CBA at a Grand Junction Caravan meeting when my boss, Congressman Jim Johnson, was to speak to the Colorado Bakers Association only to find out it was the Colorado Bankers Association. We had a good laugh at the typo, and I got a great job.

Information – CBA transitioned from hard copy bulletins mailed to recipients to electronic newsletters and websites. CBA led the way nationally in 1994 (pre-internet), with an amazing site that provided the nation’s only online access to the daily American Banker newspaper and an incredible database of all public data on individuals/companies – liens, crimes, real estate, cars, boats, planes, stocks, property tax assessment. That site later morphed into coloradobankers.org. And CBA utilized Zoom five years prior to 2020s COVID surge.

Administration – As consolidation reduced the need for education and other services, CBA staff shrunk concurrently. CBA operates with about a quarter of the staff of similarly sized states.

Today our I.T. is typical of a small business, but I recall our first computers in the late 1970s, recorded on cassette tapes, predating the now ancient 4.5” floppy disks.

We had hundreds of profitable community banks, bank CEOs who were owners (versus hired management), frequent meetings at the Broadmoor, and social CBA board and committee meetings over liquid lunches.

Regarding CBA staff, you already know Jenifer will do a great job. She’s skilled and prepared – plus, she makes the best Key lime pie. Over the decades, CBA has been blessed by other current and former great staff.

Our membership went from 100% in the 1980s to 70% after the ugly fight over branch banking and then back to over 95%.

BANKERS

Regretfully many are deceased, including good friends, but I’m grateful to have known them. Dozens of very accomplished bankers have been CBA chairs; I learned a different management lesson from each one. There are too many to mention: 47 years’ worth. I do want to thank Bob Young (Alpine Bank) & Jim O’Dell (Valley Bank, Brighton) for believing a “kid in his 20s” could handle being CBA CEO.

BANKERS ASSOCIATIONS

Other bankers associations are a big part of this job. I’ve worked with five ABA CEOs and many professional staff there. The Alliance, a powerful political entity, consists of all 50 state bankers’ associations and the ABA, working cooperatively. I had the honor of chairing that group in 1992 (good grief, 30 years ago!), which became a momentous year.

The 1992 annual meeting of those 51 organizations focused on the disastrous adoption of FDICIA in 1991 (risk-based FDIC premiums, PCAs, capital requirements). Prompted by FDICIA’s dreadful results, spring 1992 criticism of bank lobbying in the American Banker triggered a needed self-examination by ABA and the state associations. In Oct. of that year, I was the first and only state executive to address an ABA convention (5,000 bankers) and join the ABA board as the first state exec. In Nov., Bill Clinton was elected.

The 51 associations had an intense, contentious, confrontational self-critique. That infamous meeting produced a restructuring of bank advocacy, realignment of ABA and state cooperation, and improvements in mutual technology and communication. It has worked well since.

State execs collectively are motivated, dedicated, assertive professionals; they are great advocates. These colleagues (I’ve known approximately 100 during my career) are among my best friends.

OTHER PARTNERS

In 1951, CBA started the Graduate School of Banking at Colorado at CU/Boulder (one of 6 grad banking schools in the U.S.). It is banker-driven and community bank-focused and is in great shape. CBA also sponsors the Graduate School of Banking at UW-Madison.

In the early 1980s, due to government restrictions on interest rates that banks could pay depositors (Reg Q), the advent of money market funds sucked billions out of U.S. banks. CBA and several other state associations partnered with Fidelity in Boston to do nightly deposit sweeps in and out of accounts so banks effectively could pay market rates and retain deposits. Several years later, I spoke with Fed Chairman Paul Volcker at the Broadmoor; he said that the very service created by state associations was why the Fed abandoned rate regulation.

In the 1980s, insurance companies ended bond and D&O coverage for banks, and that crisis prompted a few state associations to create BancInsure. We built it, operated it for 16 years and wisely sold it in 2003. It served banks well, disbursed major dividends to CBA, insured 25% of all U.S. banks when sold, and paid CBA 39 times our investment on its sale. CBA bought a new space (debt-free) that year and remodeled it with proceeds from BancInsure.

I’m also proud of the Friends of Traditional Banking launched by colleagues in OK and UT and me after Dodd/Frank. This banking super-PAC was created in the CBA office, and to date, 27,000 bankers contributed $3.3 million in nine key races (average $367,000). We helped flip the U.S. Senate our first year.

CBA also initiated the Regulatory Feedback Initiative, now known as the Bank Exam Prep Center, to provide guidance for upcoming bank exams, especially bankers’ survey responses about issues stressed in recent exams. It started in 2006-07 as a CBA service that went nationwide in 2011. To date, 4,600 respondents have answered surveys, providing valuable insight to other bankers.

We’ve also had great fun hosting many political fundraisers featuring guests such as Speaker of the U.S. House John Boehner, U.S. House Minority Leader Kevin McCarthy, and many others. We’ve raised a lot of money and had a lot of fun.

FRIENDS AND POLITICAL BATTLES

Public officials in both parties have been CBA friends and partners over my 47 years. There are countless stories, many of which can’t be repeated. No, I will not write a colorful book.

I’ve had the pleasure of working with several wonderful people: five Colorado governors, 10 U.S. senators, 28 U.S. representatives from our state, six good friends who chaired the FDIC, numerous comrades at the Fed in Kansas City and Washington, D.C., several comptrollers, eight Colorado state bank commissioners, several dozen other statewide officials, approximately 65 bank-supportive Colorado senators, about 80 good out of perhaps 250 state representatives, and roughly 100 fellow lobbyists and political associates.

Our state government relations successes started with the first bill I lobbied into law in 1976, permitting off-premises ATMs, considered branches and therefore illegal prior to that. I take pride in ending wine and dine lobbying, but admit I got my own unofficial desk and phone when other lobbyists in pre-cellphone days had to use phone booths in the Capitol halls. That demonstrates the value of relationships.

I remember that one future governor said I saved his political life when I quietly, behind-the-scenes, facilitated crisis resolution involving illegal state funds in a failing bank. Close to $11 million in deposits were not collateralized, so the state would have lost the funds in an FDIC payoff; not good news for a state treasurer and future governor. But the FDIC was able to sell the bank to a buyer who assumed the deposits.

State treasurer Roy Romer and I flew all over the entire state with Roy piloting his plane and me navigating (with zero experience).

I’m proud that CBA often has been a ringleader at the national level in aggressive advocacy and has been recognized particularly for organizing and leading several issues:

- After being told by practically everyone that we didn’t stand a chance, a successful 1999 Y2K U.S. Senate amendment was adopted. We met with Sen. McCain, the sponsor, who said no. The U.S. Chamber opposed it, but we prevailed. I’m told that was the first reverse preemption in U.S. law where state law preempts U.S. law. That was great fun.

- For our work leading the 1992-93 bank regulatory burden relief campaign, the American Banker called CBA the catalyst and strategist of this successful nationwide effort.

- I chaired the 2014 ABA/Alliance Regulatory Relief Task Force, which resulted in significant regulatory rollback for banks.

- When the Farm Credit System sought expanded lending, CBA’s research and resulting brochure highlighted existing unauthorized FCS commercial lending. Also, it sparked a highly unusual, visible, and successful alliance on the U.S. House floor: Barney Frank from the left and Marilyn Musgrave from the right – both enemies on same-sex marriage – helped stop the expansion. That’s a good reason why you should never make enemies in politics.

OBSERVATIONS

- Colorado banking’s consolidation was painful from failures, needed when it consumed S&Ls, and pragmatic from branching, interstate, and M&A.

- One-party control has led to enormous spending, major political clashes, and a divided country.

- Ballot initiatives are a plague.

- Being proactively defensive is a CBA hallmark; that requires anticipating the future.

- I foresee continued banking challenges: Expanded regulation, reporting to government, technology and data, DE&I, environmental risk management, and pandemic and workplace.

- Colorado doesn’t need two banking associations. Banks are better served by one unified association.

Persevere, never give up; out-think and out-work opponents.

It’s been great fun. I owe a lot to many of you. Best wishes in all you do.