By Ryan Abdoo, Partner, Plante Moran

For community institutions yet to adopt CECL, complexity is not necessarily the better choice. Here are two factors to consider when selecting a method.

As we approach the end of 2020, institutions that were required to adopt the current expected credit loss (CECL) accounting standard are wrapping up their adoption year. Many of these institutions elected to use more complex methodologies than what the Financial Accounting Standards Board requires for community institutions. For community institutions yet to adopt CECL, bear in mind that complexity is not necessarily the better or right choice.

Factors to weigh when selecting the best CECL accounting method

The handful of available methods range from very complex (and costly) to simple and economical. Remember that the standard is scalable to all institutions, so while more is expected from regulators and auditors for the first wave of adopters, institutions yet to adopt the opportunity to select a scalable method to the institution’s complexity. In other words, choose your methodology carefully since added complexity inherently leads to increased cost and greater potential for error and scrutiny.

When considering your options, the first thing to ask is whether the added complexity provides enough value to justify the financial and operational burden. For example, the cost of a more sophisticated probability of default, loss given default (PD/LGD) method could prove valuable if the model was also used to perform stress testing. Since stress testing can provide insights on how a portfolio might behave under various economic scenarios, an institution could leverage the model for more strategic planning. The downside? The added cost and operational burden associated with the accumulation of accurate and complete data.

Additionally, a migration analysis could also prove valuable should your institution look to better understand how the overall portfolio behaves under certain economic scenarios. On the other hand, if you’re looking for a method that solely calculates the allowance for credit losses, the use of a simple process that can leverage your spreadsheet software and the readily available historical data from call reporting (for example, the weighted average remaining maturity method) is probably the best option.

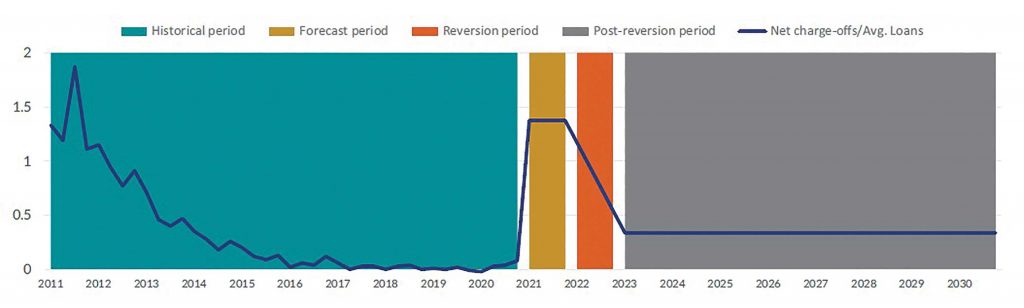

The second factor to consider is the availability of the historical data needed to calculate the allowance for credit losses under each method. As a general rule, the more complex the method, the more pieces of historical loan-level data required. For example, the migration method often asks for historical monthly loan trials with risk grades. When considering historical data, it’s also important to understand that the CECL standard requires an institution to measure losses over the life of a loan. However, this life-of-loan measurement comprises three pieces: the forecast period, the reversion to the long-term average and the long-term average. The graph below illustrates this with a common scenario — a one-year forecast followed by a one-year reversion to the long-term average.

The forecast period has been the most noteworthy in breaking down the three pieces of the life-of-loan calculation. When looking deeper into this part of the estimate, the institution will need to obtain loss information from different parts of an economic cycle to support the forecast period’s quantitative reserve amount. A challenge for many institutions that have already adopted has been the availability of the data required for a full economic cycle — specifically, historical loss data going into a recession. As a result, judgmental factors continue to be as prevalent among institutions as the incurred loss methodology used before CECL adoption. The solution to the lack of data is straightforward: Select a method with less complexity.

Let’s say your institution currently uses a loss rate methodology by looking back three to five years and calculating an average annual loss rate with additional adjustments for qualitative factors. You can continue to use this method with a few simple adjustments to leverage information readily available to you from call reports, information from the Federal Reserve and your asset/liability modeling system.

A simple approach: Measure twice, cut once

Many institutions yet to adopt CECL have decided to start with a less complex method because they have the historical data over a full economic cycle at their fingertips, which keeps the added cost and administrative effort low. Their approach reminds me of building a treehouse years ago with my dad — his favorite saying, “Measure twice, cut once,” comes to mind. Selecting a methodology and a model for CECL will come with varying levels of financial and operational burden, but don’t take on more than necessary. We encourage you to ensure well-informed decisions are being made and build your treehouse in a way that best fits your institution.

Ryan Abdoo, Partner, Plante Moran

This story appears in Issue 4 2020-2021 of the Colorado Banker Magazine.