With the remaining tenors of USD LIBOR going away on June 30, 2023, it is crucial for banks to ensure all outstanding action items for the transition have been addressed. The London Interbank Offered Rate (LIBOR) has been the dominant interest rate benchmark used in financial contracts in recent decades and is used as a reference rate in over $200 trillion worth of contracts worldwide. This guide provides an overview of the LIBOR Act and LIBOR regulations to transition what have been referred to in the market as “tough” legacy contracts without a clearly defined replacement benchmark. These new rules will automatically apply a board-selected benchmark replacement to LIBOR contracts subject to the Act after June 30, 2023.

Background

Scandals exposed around 2013 revealed that certain market players had been manipulating the LIBOR index during the 2008 financial crisis, and market confidence in LIBOR began to wane. Financial regulators and market participants began to search for alternative reference rates and develop plans for a transition away from LIBOR. Key milestones in this process include the following:

- 2014 — The Board of Governors of the Federal Reserve System (Board) and the Federal Reserve Bank of New York (FRBNY) convened the Alternative Reference Rates Committee (ARRC) to identify a recommended replacement to LIBOR.

- June 2017 — The ARRC identified the Secured Overnight Financing Rate (SOFR) as its recommended replacement for USD LIBOR.

October 2020 — The International Swaps and Derivatives Association (ISDA) published the ISDA 2020 IBOR Fallbacks Protocol (Protocol), a contractual protocol by which parties to derivative transactions governed by ISDA documentation and other financial contracts can agree (by electing to adhere to the Protocol) to incorporate robust contractual fallback provisions that replace LIBOR with an alternative benchmark based on SOFR. - November 2020 — The Office of the Comptroller of the Currency (OCC), Board, and Federal Deposit Insurance Corporation (FDIC) issued an interagency statement stating that banking organizations should generally not enter into new contracts referencing USD LIBOR after December 31, 2021.

- March 2021 — The United Kingdom’s Financial Conduct Authority (FCA) announced that after December 31, 2021, the ICE Benchmark Administration Limited (IBA) would cease publishing 24 currency and tenor pairs (known as settings) of LIBOR; however, it would continue to publish the overnight, and one-, three-, six-, and 12-month tenors of USD LIBOR through June 30, 2023. The FCA also proposed that the IBA continue publishing the one-, three-, or six-month USD LIBOR settings on a “synthetic” basis until September 30, 2024, even though such synthetic LIBOR settings are “not representative of the markets that the original LIBOR settings were intended to measure.”

- April 2021 — New York adopted N.Y. Gen Oblig. Law art 18-C addressing the effect of LIBOR discontinuance on contracts. Following this, other states (including Alabama, Florida, Indiana, Nebraska and Tennessee) adopted similar legislation.

- March 2022 — Congress enacted the Adjustable Interest Rate (LIBOR) Act (LIBOR Act) to establish a set of default rules to apply to “tough” legacy contracts subject to U.S. law (i.e., contracts that use LIBOR as the reference rate but do not include adequate fallback provisions in the event LIBOR is discontinued).

- December 2022 — Pursuant to its authority under the LIBOR Act, the Board approved its final Regulation Implementing the Adjustable Interest Rate (LIBOR) Act (LIBOR Regulations).

- June 30, 2023 — Scheduled date for cessation of the overnight and one-, three-, six-, and 12-month tenors of USD LIBOR.

What is SOFR?

The Secured Overnight Financing Rate (SOFR) is a broad measure of the cost of borrowing cash overnight collateralized by U.S. Treasury securities and is published by the Federal Reserve Bank of New York. There are several differences between LIBOR and SOFR including the following:

- LIBOR is unsecured and therefore includes an element of bank credit risk, which may cause it to be higher than SOFR.

- LIBOR may include term premiums and reflect supply and demand conditions in wholesale unsecured funding markets, which may cause LIBOR to be higher than SOFR.

- LIBOR is a forward-looking rate (meaning that the rate is known at the time it is applied), while SOFR is inherently a backward-looking rate (meaning that the rate is not known until the end of the calculation period). This initially caused some consternation among the credit community; however, the ARRC-recommend CME Term SOFR is forward-looking tenor of SOFR.

Like LIBOR, there are different tenors of SOFR, including:

- Fallback Rate (SOFR): a term adjusted SOFR plus a spread relating to USD LIBOR, published by Bloomberg Index Services Limited. Fallback Rate (SOFR) is a form of compounded SOFR in arrears.

- CME Term SOFR: a daily set of forward-looking interest rate estimates calculated and published by CME Group in one-, three-, six-, and 12-month tenors. The use of CME Term SOFR is subject to certain licensing and other usage terms imposed by CME Group; however, under present usage terms, an end user1 seeking only to enter into a transaction using CME Term SOFR does not need a license from CME Group. Further, CME Group has waived fees for users of CME Term SOFR for cash transactions through 2026.

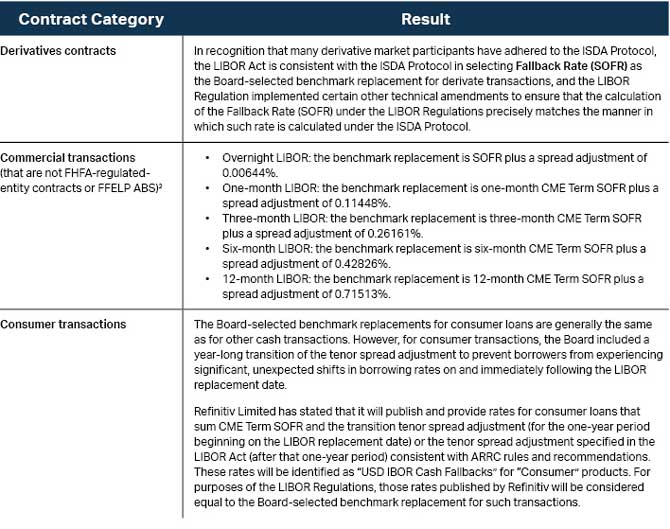

Although LIBOR is a credit-sensitive rate and SOFR is a risk-free rate, they still generally trend together, except in rare periods of market disruption. To account for the “normal” difference based on a five-year historical median, the ARRC recommended spread adjustments in 2021, and the LIBOR Act includes spread adjustments corresponding to the different tenors of CME Term SOFR. Also in 2021, the ARRC published several recommended best practices for SOFR conventions in various types of loan transactions and for various tenors of SOFR.

In selecting SOFR as the basis for the Board-selected benchmark replacements under the LIBOR Act, the Board asserts that it was guided by voluntary market practices, as in large part the loan market for cash (not derivative) transactions had already transitioned from LIBOR to Term SOFR. The Board’s selection of the SOFR-based replacement rates is intended to minimize market disruption.

Summary of the LIBOR Act and LIBOR Regulations.

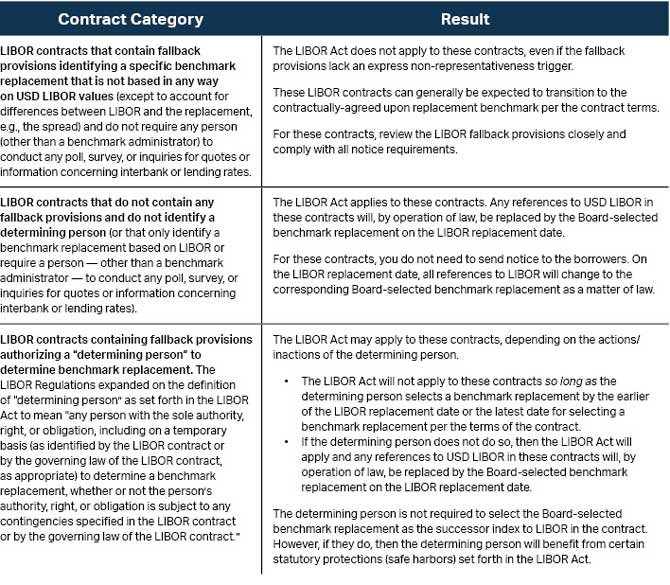

As the purpose of the LIBOR Act is to establish a clear and uniform process for addressing legacy contracts, the LIBOR Act and LIBOR Regulations only apply to contracts that (1) are governed by U.S. law or the laws of any U.S. state, (2) reference the overnight or one-, three-, six-, or 12-month tenors of USD LIBOR, and (3) do not have fallback provisions that provide for a clearly defined and practicable replacement benchmark for LIBOR, unless the parties to the contract agree in writing that the LIBOR Act does not apply. In addition, certain protective provisions of the LIBOR Act and LIBOR Regulations would also apply to a contract where the “determining person” elects to use the “Board-selected benchmark replacement” (as such terms are further described below).

Generally speaking, contracts that fall within the scope of the LIBOR Act are affected by the LIBOR Act as follows: On the LIBOR replacement date (i.e., the first London banking day after June 30, 2023, assuming no further delays), all references to LIBOR in the subject contract will be replaced with the corresponding Board-selected benchmark replacement.

The LIBOR Act and implementing regulations also permit “benchmark replacement conforming changes” for non-consumer loans, provide a safe harbor for contracts subject to the LIBOR Act, and preempt conflicting state or local laws. Other provisions of the LIBOR Act amend the Trust Indenture Act of 1939 (15 USC 77ppp(b)) and the Higher Education Act of 1965 (20 USC 1087-1(b)(2)(I)); however, a discussion of those provisions is beyond the scope of this article.

What This Means for Your Bank

A. Does the LIBOR Act apply to my contract?

B. What is the Board-selected benchmark replacement?

Other Considerations

A. Technology Systems and Analytics Models

Apart from ensuring that you are LIBOR-fallback-ready from the documentation perspective, you must also ensure that your bank is ready from the technology perspective. All loan and trading systems that use LIBOR as the reference rate will need to be re-coded to support the applicable tenor of SOFR. In addition, any analytics models used by your bank to ensure the appropriate evaluation of loan transactions (including those for pricing funds and evaluating risk) that are based on LIBOR will need to be updated or rebuilt to support benchmark replacements based on SOFR. By the end of 2020, most major loan system vendors created updates to support multiple calculations of SOFR. You should ensure that your bank has installed these updates and also test these systems (as well as user interfaces and downstream systems) before it’s time to go live.

B. Contracts Subject to Swap Arrangements Require Special Attention to Ensure a Matching Hedge

Any loans that are subject to hedging arrangements require special attention to ensure that the benchmark replacement and manner of calculation under the loan with your customer match the swap. As noted above, the board-selected benchmark replacements for derivatives transactions and for non-derivatives transactions are significantly different. If no action is taken and the board-selected benchmark replacement takes effect as a matter of law, then payments under the loan agreement will be different from payments under the hedge agreement, resulting in a mismatched hedge and increasing basis risk. If you are the “determining person” under the loan documents, then you can avoid a mismatched hedge by sending the borrower a notice prior to the deadline set forth in the LIBOR Act (i.e., the earlier of June 30, 2023, and the date required under the loan documents). However, if that contract falls under the scope of the LIBOR Act and you are not the “determining person,” then you should contact the borrower and consider entering into a separate amendment of the subject loan agreement to ensure alignment with any related hedge transactions. As noted above, parties may elect for a contract to not be subject to the LIBOR Act by mutual agreement.

Selena Samale is an attorney in Stinson LLP’s Banking & Financial Services Practice Division. She can be reached at selena.samale@stinson.com.

- Defined by CME Group as “an individual or entity that is a counterparty or guarantor to the applicable cash transaction or derivative transaction with the licensee of CME Term SOFR.”

- LIBOR contracts that are commercial or multifamily mortgage loans purchased or guaranteed, in whole or in part, by an FHFA-regulated entity (as defined in 12 U.S.C. 4502(20)) and Federal Family Education Loan Program (FFELP) Asset-Backed Securitization (ABS) are treated differently under the LIBOR regulations. For brevity, a discussion of these types contracts is omitted from this article. For more information, see 12 C.F.R. § 253.4(b)(3)-(4).