Hedging tools allow banks to prepare before next quarter’s volatility — and potential rate change.

Financial markets have been rocked by significant volatility in 2022.

Over the first six months of 2022, the 10-year U.S. Treasury rate jumped from 1.52% to 3.2%. A confluence of events is driving that volatility: increased inflation expectations led to more significant and sooner-than-expected increases in the Federal Funds rate, the uncertainty of the first military conflict in Europe since World War II, and the economy. Financial institutions are finding themselves in very turbulent waters.

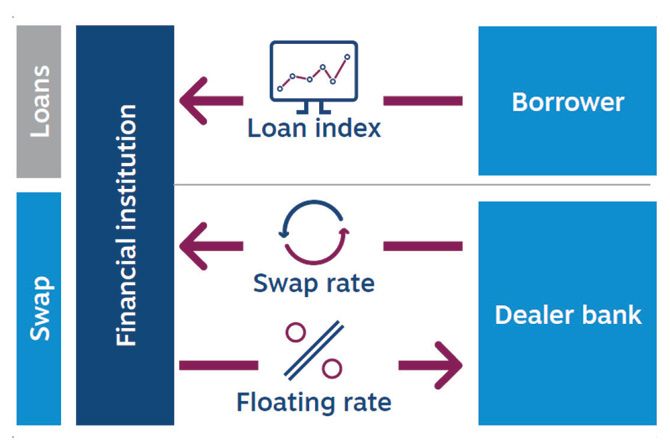

Banks prepared for this possibility are navigating these choppy waters with greater ease. They’re using prudent risk management tools, like interest rate swaps, to smooth earnings and protect against continued increases in long-term rates. Swaps create more flexibility for banks: they can be quickly and easily implemented and allow institutions to bifurcate the rate risk from traditional assets and liabilities.

Most banks use hedging strategies that aim to smooth earnings. For example, banks use an interest rate swap to convert a portion of their floating-rate assets to fixed. They lock in the market’s rate expectations and bring forward future expected income.

The benefits of this strategy:

- Synthetically converting pools of floating-rate assets via a swap extends the duration of assets, reduces asset sensitivity and increases current earnings.

- This helps banks monetize the shape of the yield curve by bringing forward future interest income and producing smoother net income.

When it comes to hedging floating rate loans, we see a mix of Fed Funds (to hedge loans tied to Prime), SOFR, LIBOR, and a handful of banks using the Bloomberg Short-Term Bank Yield (BSBY) index. Additionally, hedging floating rate loans with floors requires special considerations.

On the other side of the spectrum, those banks hedging for rising rates primarily use swap and cap strategies to reduce duration risk in the loan and bond portfolio. Notably, the Financial Accounting Standards Board recently introduced the portfolio layer method, allowing banks to swap pools of fixed-rate assets like loans or securities to floating.

The benefits of this strategy:

- Synthetically converting fixed-rate assets via a swap shortens the duration of a bank’s balance sheet and hedges rising rates.

- Creates more capacity for a bank to do more fixed-rate lending.

- Swaps can start today or in the future, allowing banks to customize the risk mitigation to their risk profile.

In the turbulent seas of this current moment, banks prepared to use hedging strategies enjoy the benefits of smoother income and mitigated rate volatility. They also benefit from their flexibility: banks can quickly execute swaps, allowing them to bifurcate the rate risk from traditional assets and liabilities. Finally, derivatives have low capital requirements, resulting in minimal impact on capital ratios.

Adding hedging tools to the tool kit now allows your bank to get ready before next quarter’s volatility — and potential rate change — is a best practice that can be accomplished quickly and efficiently.

Ben Lewis is a Managing Director and Global Head of Sales for Chatham’s Financial Institutions practice. He currently leads our business development efforts in the Western U.S., and since joining Chatham has worked with depositories of all sizes helping them manage interest rate risk through the prudent use of hedging strategies. Prior to his work with financial institutions, Ben worked with private equity firms and REITs to hedge their interest rate and foreign currency risk. You can contact him at LinkedIn — https://www.linkedin.com/in/benlewis98.