Commercial lending is a saturated and highly regulated field.

As if that were not enough, lenders often must fight not only their competitors but their own internal processes as well. A surprising number of commercial lending institutions continue to rely on outdated document collection methods such as paper forms, in-person meetings, Excel spreadsheets, and manual workflows.

Over time, this inevitably takes a toll on their productivity and ability to scale.

The good news is that automating document collection is possible – and by doing so, commercial lenders can effectively optimize their processes, save time and money, provide better customer service and improve their bottom line.

What Is Automated Document Collection?

Automated document collection leverages modern digital tools to prepare, send, sign, collect, modify, and save client documents automatically and with minimal human intervention. The goal is to streamline document handling, reduce administrative errors, provide quicker and better customer service, and improve productivity overall.

Digitization vs. Automated Document Collection

Automated document collection is different from document digitization, which merely replaces paper documents with electronic, but still requires a fair amount of manual intervention and oversight.

Automated document collection goes beyond converting analog into digital data. It completely transforms the document handling process and reduces the need for human intervention to the bare minimum.

Electronic vs. Automated Document Collection

There are many tools currently on the market that offer some form of electronic document collection. Most commercial lenders will doubtless be familiar and likely use some of the more popular ones, such as:

- Dropbox: Rather than emailing documents around, Dropbox enables users to share files with coworkers and clients by uploading them to an online folder to be downloaded by whoever has access.

- ShareFile: ShareFile offers secure file sharing, sync, and content collaboration solutions through a dedicated client portal.

- DocuSign: The company was one of the early pioneers of e-signature technology, helping digitize the agreement process. DocuSign users can prepare, send, and sign agreements on almost any device.

- Adobe Send & Track: This Adobe Document Cloud service enables users to send files as links, track them, and get confirmation receipts when the recipient opens the file.

While they once were a real game-changer, electronic document collection tools are becoming increasingly obsolete in the financial services industry.

A new generation of document collection systems now combines the various features of these older applications with more sophisticated and powerful yet easy-to-use workflows. In addition to boosting productivity, modern automation solutions can improve businesses’ credibility with clients, partners, investors, and other third parties.

Five Document Collection Challenges Facing Modern Commercial Lenders

Most commercial lending institutions these days will have faced at least one of these common workflow bottlenecks:

1. Document Collection Teams Are Drowning in Paper

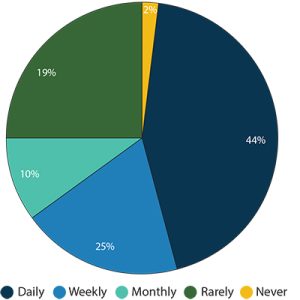

Despite having access to more modern solutions, many lenders continue to rely on paper. They are not alone in this. Over 44% of businesses still use paper documents daily, and U.S. corporations spend more than $120 billion every year on printed forms alone. Most of these will be out of date within three months.

Manually filling out, sending, and chasing paper forms – only to then reenter the same information in the internal software system – makes an already document-heavy process even more time- and labor-intensive.

The issues with this approach are obvious.

How Often Do Employees Across Industries Use Paper?

2. Manual Workflows Are Slowing Everything Down

Even where lenders have largely transitioned from paper-based to digital documents, manual processes are rampant.

Dedicated employees spend hundreds of business hours chasing lost DocuSigns and application forms, sending reminders to clients about supporting documentation, and manually keying in data into gigantic Excel spreadsheets.

In addition to being massive time- and money-wasters, manual workflows are notoriously error-prone.

IBM reports that as many as 90% of spreadsheets have errors that affect their results, and research on comparative data entry methods suggests that manual verification results in 2,958% more errors.

3. Scaling Up Is Extremely Expensive

There is only one way for lending institutions to scale their business: by expanding their customer base and approving more loan applications in less time. Traditionally, this was done by hiring more employees.

The problem with this approach is that human agents are incredibly expensive. They are also not that effective at increasing document processing speed.

A (somewhat) better way to boost document handling capacity was to hire a team of developers, either in-house or externally, to build a custom document collection system or invest in an off-the-shelf product.

But this was not an ideal solution, either. Developers do not exactly come cheap and building an in-house solution can take a long time. Prior to the introduction of cloud-based automation solutions, ready-to-use software was also not always up to the task.

4. Frustrated Customers Are Dropping the Onboarding Process

To this day, an overwhelming number of lenders still rely on in-person meetings, email, and, perhaps worst of all, post to collect financial documents from clients. All too often, business owners looking to apply for funding or simply open a new account are told they need to book an appointment and spend half a day traveling, waiting in lines, and filling out paperwork.

The long-handling times and document-heavy workflows with multiple touchpoints, many of which unnecessary, frustrate clients. Some end up abandoning the process altogether and resort to more flexible providers such as alternative lending institutions or tech-forward incumbents.

5. Compliance Is Eating Up a Big Chunk of the Budget

The commercial lending space is highly regulated. Keeping up with the ever-changing regulations – from Know Your Customer (KYC) to Anti-Money Laundering (AML) requirements and beyond – and staying compliant at all times eats up a lot of time, money, and human capital.

Compliance is also one of the reasons many commercial lenders hesitate to adopt new electronic solutions. They are concerned, and rightly so, about the regulatory implications.

The Benefits of Automated Document Collection

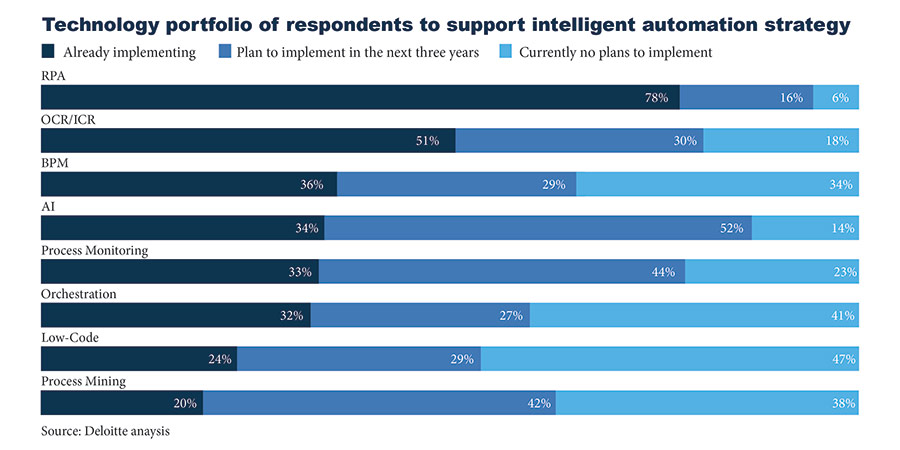

In its latest Global Intelligent Automation Survey, Deloitte reported that 78% of the surveyed executives – including CFOs and finance directors – said that their organizations were currently using some form of Robotic Process Automation (RPA). A further 16% planned to do so in the next three years.

And no wonder. Here are just some of the benefits of automating document collection in the commercial lending sector:

1. Drastically Reduced Processing Times

Automation enables lending institutions to collect financial evidence and other supporting documents more quickly than ever before. Where it once took teams days, weeks, and sometimes months to collect, review, and process client documentation, automation technologies can accelerate the application process to just a few minutes.

Automation also helps speed up time to close from what can be months to six to 13 weeks. In some cases, deals can close in under four weeks. This not only enables lenders to process more applications in less time but also frees employees up to focus on more impactful activities than pushing paper, such as revenue generation and customer service.

2. Streamlined Workflows and Optimal Use of Resources

Automated document collection effectively:

- Eliminates paper piles

- Clears inbox clutter

- Minimizes manual data entry

- Reduces the reliance on spreadsheets

- Improves file structure and organization

Lending teams no longer must sift through a never-ending drip feed of emails with different attachments just to find a single form or ask for an update. Wasting hours hunting for missing, poorly labeled, or misfiled documents is also a thing of the past.

3. Fewer Errors and Improved Compliance

The less financial services organizations rely on manual entry, the lower the potential for costly human errors. Thanks to automation, there is no need for employees to manually enter and verify important data. Because of the above-human accuracy of automation solutions, teams also do not have to go back and forth correcting errors, mistakes, and omissions across multiple spreadsheets.

Most automation solutions were also specially developed for the needs of the financial services industry. This means they are fully compliant with all relevant SOC2-Type 2 and other regulations, ensure secure document collection, and integrate seamlessly with the most commonly used internal software and CRM systems.

4. Better Customer Service

Quicker processing times and remote document collection directly translate into better customer service, higher client satisfaction, and lower dropout rates. In addition to servicing clients faster, employees have more time to answer queries, solve customer problems, and promote financial products.

5. Improved Bottom Line

Perhaps the biggest benefit of automated document collecting is its impact on ROI. It helps save time and money on repetitive mundane tasks, makes it possible to approve more applications in less time, and spares lending institutions from having to increase their headcount just so that they can scale.

As a result, most lenders see a rapid improvement in their bottom line shortly after implementing automation into their workflows.

Automated Document Collection in Commercial Lending: Final Thoughts

While fintechs and alternative lenders were the first to embrace automation solutions, traditional banks are quickly catching up on the potential of modern technologies. To remain competitive in this highly saturated industry, commercial lenders need to start incorporating automation as soon as possible and before it is too late.