In a December 2021 poll of banking executives, we asked respondents two questions about their outlook and concerns for 2022.

First, we asked what concerns their ALCO committee the most. It wasn’t inflation. Despite all the headlines and press that inflation is currently receiving, that wasn’t bankers’ primary concern. It was the combination of low yields and the resulting NIM pressure that captured the concern of nearly 70% of the 100-plus bankers responding.

Second, we asked what concerns their financial institution the most. Again, inflation or rising rates to tame inflation was not the primary concern. The main worries for 61% of respondents were rates staying low for an extended period, and particularly the long end of the yield curve staying low or even going lower.

What can a bank do to manage its balance sheet against a lower for longer rate scenario, especially when it’s flush with deposits?

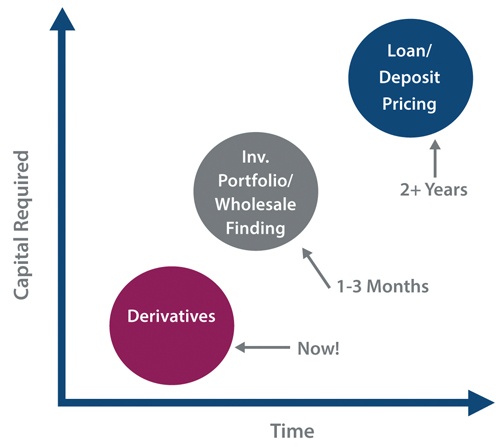

- Make more long-term fixed-rate loans. In the current environment, with banks flush with liquidity and loan demand below historical norms, this is a challenging proposition. Even if loan demand is strong, it requires time and capital.

- Buy fixed-rate bonds. The CFO/treasurer can deploy liquidity through the bond portfolio. Credit risk is mitigated, but it is inefficient both from time (it can take months to find enough quality assets to buy) and capital.

- Use a swap to bring forward interest income. An interest rate swap allows ALCO committees to instantaneously change the interest income on an asset or liability while using very little capital. Client requests, investment decisions, and funding choices can be optimized rather than driven by their associated interest rate risk profile.

Why do banks use derivatives to hedge their balance sheet?

- Efficiency. It’s efficient from both a timing and capital perspective. In a late 2021 earnings call, when outlining their hedging strategy, financial institution CFO John Woods said, “We think it’s a bit more efficient to do that (manage interest rate risk) off-balance sheet with swaps.”

- Flexibility. It’s more flexible than changing loan and deposit availability and pricing.

- Cost. It’s often less expensive when compared to cash products.

Why are some banks hesitant to use swaps?

- Perception of riskiness. For a bank that hasn’t used derivatives, it is easy to fall into the fallacy that swaps are a “bet” on rates. In a sense, though, all the bank’s balance sheet is a “bet” on rates. When layered into the bank’s ALCO conversations and tool kit, swaps are simply another tool to manage rate risk, not add to it.

- Accounting concerns. Banks frequently cite accounting concerns about derivatives. But recent changes from the Financial Accounting Standards Board have flipped this script – hedge accounting is no longer a foe but a friend to community banks.

- Fear of the unknown. Derivatives bring an added layer of complexity, but this is often overdone. It’s important to partner with an external service provider for education as well as the heavy lifting both upfront and ongoing. The bank can continue to focus on what it does best: thrilling customers and returning value to shareholders.

- Competing priorities. Competing priorities are a reality, and if something is working, why bother with it? But growth comes from driving change, especially into areas where the bank can make small incremental changes before driving significant change – banks can transact swaps as small as $1M or less.

For banks that have steered clear of swaps – thinking they are too risky or not worth the effort – an education session that identifies the actual risks while providing solutions to manage and minimize those risks can help separate facts from fears and make the best decision for their institution.

Community banks should leverage hedging strategies to enhance yield, increase lending capacity, and manage excess liquidity.