Interest derivatives can play an essential role for banks – large and small – that would like to manage their interest rate risk position. All banks must report their A/L results and all banks observe these numbers to monitor their strengths, weaknesses and capital/earnings at risk. Many management teams take a reactive approach to ALCO – stay the course unless we get out-of-bounds, or let market demand and our customers drive our asset/liability profile and hope rates don’t hurt us. Interest rate swaps can put management teams back in the driver’s seat and help protect or build NIM, preserve capital, drive fee-income and shore-up exposures. Let your lenders and deposit gatherers create interest rate risk – it is the job of management to control it. A considerable number of banks have been forced to confront their balance sheet volatility because of market unpredictability. Interest rate swaps can help management teams proactively and efficiently support future growth.

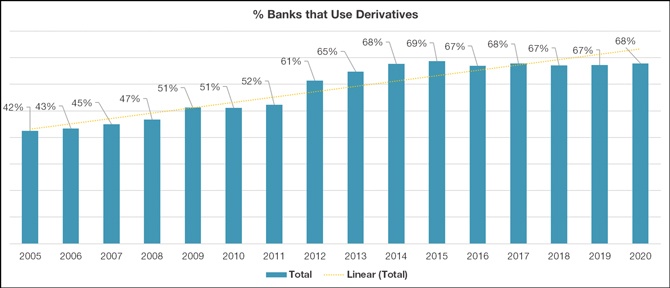

Derivatives usage has risen meaningfully over the past decade among community and regional banks. The below chart shows banks $1 billion-$20 billion in assets that use interest rate derivatives. Note the steady increase over time, with 68% of community and regional banks involved in derivatives versus 42% in 2005.

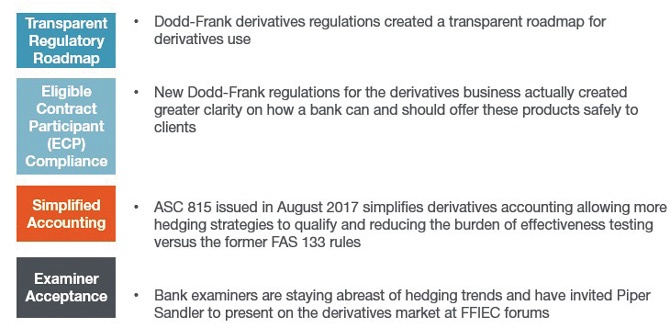

Why has derivative use increased among banks? Some would point to education, increased information and increased competition, but some very tangible factors have changed. If your most recent derivatives experience was more than 10 years ago, there have been some significant developments. The entire marketplace has become more straightforward and more transparent, driven by streamlined accounting and regulation. The next table highlights some major shifts impacting the interest rate swaps market.

The swaps market is also liquid and highly customizable, giving the bank an ability to quickly source the right instrument and unwind the hedge early, in part or whole, at a low cost (if needed). There is also a variety of items hedged on a balance sheet: borrowings, deposits, loans, and securities are all commonly hedged items depending on which asset or liability needs to change from floating to fixed or fixed to floating.

Which swap instrument is suitable for my institution? The proper transaction and customizing swaps to your bank’s needs often depend on your concerns and your desired balance sheet position. Some common transactions and examples are:

- Asset sensitive? Consider a receive-fixed interest rate swap (exchanging floating rate asset terms for fixed-rate terms) to “earn the curve” and add to current income.

- Concerned about TCE and the impact of a steepening yield curve on AFS securities? Pay-fixed on a swap of fixed assets to floating to reduce asset duration, or extend liability duration by swapping variable liabilities to fixed.

- Concerned about rising deposit costs? Consider a cap purchase (adding a ceiling to a floating rate liability) on public fund deposits or other deposit types that show a correlation to market rates.

- Trying to meet borrower demands for long-term fixed-rate loans while managing interest rate risk? Consider a back-to-back program or swapping fixed-rate loans to floating.

Take an interest in interest rate swaps and consider how this simple financial tool can help protect your institution, drive income and preserve capital. The first step is education, and finding a partner who will teach your team and understand your institution is critical. The opportunity is now.

If any of our observations pique your interest, please contact your Piper Sandler representative or email us at PSFS@psc.com. For derivatives, please email our affiliate, Piper Sandler Hedging Services, LLC, at FSG-Derivatives@psc.com.