By Scott Polakoff, CAMS, Executive vice president with FinPro

Many banks across the country are at risk of CAMELS downgrades, increased deposit insurance assessment premiums and regulatory enforcement actions due to inadequate risk management practices for their COVID-19 Loan Modification Program.

Loan modifications have been part of most banks’ lending operations for many years. Before the coronavirus, such modifications were often prompted by a borrower’s “financial distress.” Banks would attempt to work with the financially distressed borrower by granting a “concession” that the bank otherwise would not consider other borrowers with a similar risk profile. An example of such a loan modification might be an interest rate reduction from 5% to 3% for 12 months to help a financially distressed borrower. Generally speaking, this type of loan modification would be categorized as a Troubled Debt Restructure (“TDR”) under accounting literature (ASC 310-40) and captured as such in Call Reports. TDRs are considered impaired loans.

Many banks have COVID-19 Loan Modifications approximating 25% of their commercial portfolio.

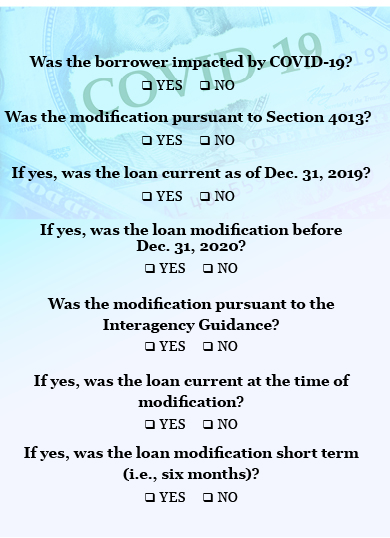

When the country became engulfed with the coronavirus, both Congress (Section 4013 of the CARES Act) and the Regulators (April 2020 Interagency Guidance) issued material to guide banks on TDR designation for COVID-19 related loan modifications. Bankers must understand that while Section 4013 and the April 2020 Interagency Guidance both discuss the applicability of TDRs, they have materially different requirements (modification duration, date of record for current/delinquency status, etc.) for determining when the TDR designation is necessary. FinPro urges all banks to specifically designate whether the COVID-19 Loan Modification was approved under Section 4013 of the CARES ACT or under the April 2020 Interagency Guidance. This document should be in each loan modification file and address the items shown in the graphic.

Remember that banks must maintain records on the number and dollar amount of loan modifications approved under Section 4013 of the Interagency Guidance and report this data to the board of directors on a regular basis.

The TDR determination is only the first step in the COVID-19 Loan Modification process.

Unfortunately, too many banks neglect to implement the second step in the COVID-19 Loan Modification process, which is vital to accurately identify, measure, monitor and control the bank’s risk profile.

Banks must properly “Risk Rate” COVID-19 Loan Modifications and incorporate such risk ratings into their ALLL/ACL calculations. Loans modified under Section 4013 or the Interagency Guidance pertain ONLY to borrowers who have been impacted by the coronavirus. By definition, these borrowers have financial performance less robust than before COVID-19. In some cases, these borrowers may have serious cash flow problems driven by the coronavirus that impact their ability to service their debt. It is incumbent on banks to accurately “Risk Rate” these borrowers at the time of loan modification and on a regular basis going forward. FinPro has observed that many banks have internally “risk-rated” their COVID-19 loan modifications to a “watch” category.

Moreover, these new risk ratings must be incorporated into the ALLL/ACL calculation. One “best practice” observed for community banks across the country is to establish a “homogenous pool sub-tier” within the ALLL/ACL methodology to break out all such loan modifications within each homogenous pool. It is noteworthy that this approach is often used in conjunction with a new “COVID-19 Q-Factor” that many banks now incorporate their ALLL/ACL methodology. Some banks have actually appended a one- or two-digit code to COVID-19 loan modifications to ensure easy identification over time.

Lastly, effective corporate governance is critical to avoid CAMELS downgrades and enforcement actions. Corporate governance starts with a comprehensive documentation process. As noted earlier, banks must maintain records of all COVID-19 loan modifications, specifically noting whether such modifications were executed under Section 4013 of the CARES Act or the Interagency Guidance. Remember, modifications cannot fall under both categories since they have different (and competing) requirements. This information should be reported to the board of directors on a regular basis. Similarly, the management must inform the board of risk rating trends for COVID-19 loan modifications and how such ratings have impacted the bank’s ALLL/ACL. These actions, together with updated policies and procedures to incorporate coronavirus actions, robust MIS and Risk Management practices, and comprehensive Internal Controls will properly prepare banks to address any regulatory concerns.

Scott Polakoff, CAMS, is executive vice president with FinPro, a full-service management consulting firm specializing in providing advisory services to the financial institutions industry. He can be reached at spolakoff@finpro.us/

www.finpro.us

This story appears in Issue 2 2020-2021 of the Colorado Banker Magazine.