By Matt Helsing | mhelsing@pcbb.com | www.pcbb.com

Being a member of the C-suite can be demanding, as you are responsible for the health and resiliency of your institution. The challenge in leading any organization is ensuring that the right questions are asked, the right priorities are set, and the right amount of resources are allocated. Choosing the right priorities is not unlike triaging patients in a busy emergency department on a Saturday night. Make the right choices, in the right order, and people thrive. Miss an important symptom, and the consequences may be dire. In this credit cycle, how do you triage quickly? This will depend on your institution’s current situation.

Handling regulatory orders.

First and foremost, you will want to address any regulatory orders or any open examination issues. Are examiners asking you detailed questions about debt coverage ratios or changes in your customers’ FICO scores since the start of the pandemic? Are you being asked repeated questions about certain segment concentrations? If that’s the case, this is urgent and needs to be handled ASAP.

So, how do you best handle it? With a loan portfolio bottom-up, perform a detailed stress test — one that will provide you and your institution with specific, supportable results by showing the different stressed scenarios and their impact on your capital. You should also dig deep into cash flows, the borrowers’ statements and their supply chains. If you have the resources and the time, then this is your top internal priority. If you don’t have time to complete that detailed analysis or you’re missing information, then you need a third party to help.

Demonstrating resiliency.

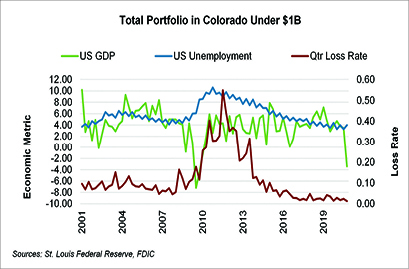

Triaging to the next level, urgent but not critical, you will need to be prepared to satisfy examiner expectations for institution resiliency. Examiners are going to ask specifically about the effects of the pandemic on your institution. While this can be answered with a bottom-up loan portfolio stress test, a faster alternative is a complete, quick top-down test. This approach uses the historical relationship between unemployment, GDP, and industry data loss rates. Using multivariate regression combined with future forecasts, you can quickly generate estimated loss rates. If the relationship between GSP (gross state product), state unemployment, and loss rates remains highly correlated, state data can be used instead of national data. Loans can also be segmented by industry classifications.

Recovery scenarios.

The next step is to decide which recovery scenarios are the most likely to show adequate stress on your portfolio. With the large banks, the regulatory agencies asked that they simulate stress under V-, U- and W-shaped recoveries. You should also consider an L-shaped recovery scenario, which generates the longest period of losses. Under this scenario, unemployment is assumed to remain above 10% through Q1 2022, and during the same period, there is no economic recovery.

When you’re asked about your resiliency — how future events affect your portfolio — you will know the answer with this swift top-down approach. Using the same regression model, the economic metrics forecast is adjusted to simulate the different types of recoveries resulting in different loss rates.

Consider Colorado as an example. Using Colorado’s historical loss rates with the highly correlated national data for GDP and unemployment, we find that Colorado’s aggregate capital levels under the V-, U- and W-shaped recoveries remain well above regulatory minimums. We also discover that total risk-based capital, barring a long-term recession such as expected in an L-shaped recovery, remains adequate.

Your actual results depend on several factors, such as your actual losses compared to state averages, your actual forecasts, tax rates and eligibility for loss carrybacks, in addition to the timing of the recovery or future infections in your local economy. However, by triaging effectively, you can focus your institution on the most needed activities. Once you have a top-down view, you can decide if it makes sense to spend time on more detailed actions.

Matt Helsing is the Northwest regional manager for PCBB. Matt works with community banks across the nation, solving risk management challenges. www.pcbb.com | mhelsing@pcbb.com

This story appears in Issue 2 2020-2021 of the Colorado Banker Magazine.