By Alana Levine, Fintel Connect

The past several months have proven to create a lasting change in our banking ecosystem. This new normal’s immense pressure has forced financial institutions to adapt quickly to changing ecosystems, evolving customer needs and shifting regulatory frameworks. Fortunately, the demand for rapid change also presents an exciting opportunity for bank marketers to leverage digital power to drive their bank growth forward.

For banks, digital marketing is no longer a nice-to-have — it’s a must. Instead of traditional face-to-face contact, banks are feeling the urgency to create more customer-friendly digital experiences. This is on top of the ever-present competitive influences and increasing costs of doing business.

As a bank marketer with limited budgets and resources, how can you set yourself and your bank up for success? Before you spend on digital marketing channels, there are five key areas that we suggest tackling first. Once you’ve addressed these, your bank will be well on its way to seeing digital success.

One: Having a Strong Digital Foundation is Key

Just like you would invest in a practical layout for your branch, the same goes for your digital real estate — first and foremost, your website. It is important to apply the same care and quality to planning and creating the digital environment of your web and mobile banking experience.

When you do, there are two important advantages for banks. Firstly, an easily accessible website with an intuitive layout and contemporary design creates confidence and credibility with your customers. More and more financial institutions prioritize this: 81% of financial services companies say that digital customer [experience] optimization will be central to their marketing efforts this year, according to a PwC survey.

Secondly and arguably more importantly, a clean and friendly user journey increases the chances of a website visitor ultimately becoming a customer. Millennials are twice as likely to open an account based on experiential factors, which means investing in user experience is a must if you want to reach younger customers (PwC).

If creating forms within your ecosystem is an undertaking, try making small changes that can often have a big impact on your customers’ experience:

- Create clear navigation at the top of the page for easy access to the most frequented pages

(hint: check out your Google Analytics to see which pages these are). - Have clear calls to action with bright colors that attract the visitors’ eyes to take the desired action.

- Add content that provides value to your audience — helpful tips on personal finance can go a long way to building rapport.

Two: Goal Setting

More often than not, tangible goal setting is an area that falls secondary in the marketing planning process. To quantitively measure your strategies’ impact, a basic tenet is to set SMART goals (specific, measurable, attainable, relevant and time-based).

Whatever marketing dollars you allocate to specific channels and tactics, ensure that spending them moves the needle and makes a net-positive impact for your bank. Your goals can tie directly back to your bank’s overall business objectives to achieve this. For example, if the bank is focused on growing its deposit base, ensure marketing initiatives directly support this goal — and can be easily measured (hint — this is step 3!)

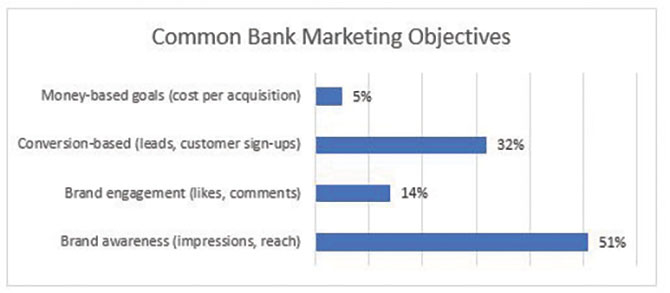

You can focus on not just traffic (visibility) goals and conversion-based goals but also value-based goals as well. This means knowing where the most customers are coming from and where the most valuable customers are coming from.

Survey: We asked banker attendees of a past webinar what their typical objectives are for their bank’s marketing activities. Here are the results:

Three: Make Sure You Measure

A major advantage of digital marketing is the ability to measure what’s working (and what’s not). Before you begin implementing strategies, make sure your tracking and measurement fundamentals are in place. This will provide you with a clear picture of where your budget is working for you and how it contributes to your results-based goals.

Many bank teams are already investing in implementing Google Analytics to track traffic on-site. It gives teams an understanding of where customers are coming from and their behavior when they enter your ecosystem. When investing in acquisition-type tactics, you’ll also want to be able to see which channels are driving the most completed sign-ups, funded loans and even deposit volumes, as this can tell you where to shift your focus (and budgets) over time. While it may seem like an impossible task depending on your current infrastructure or back-end technology providers, it is not as much heavy-lifting as you think. And we promise it’s an investment worth making when you look to invest your budget in these channels!

Four: Find the Channels that Work for Your Bank

When allocating funds to your digital marketing budget, several factors may influence your choices of channels and tactics to select. Having clear, results-based goals is the start. What are you aiming to achieve with your efforts? For example, is it net new mortgage customers or growth in customer deposits? Next, consider your audience — define who you are looking to target and their needs. The approach for first-time homebuyers versus retirees, for instance, maybe be dramatically different.

From there, select the channels and messaging that align with your goals. Digital marketing has an expansive breadth of channels that serve various stages of the customer lifecycle. For example, search engine optimization tactics (SEO) can get your bank’s content in front of high-intent customers looking for a specific product or service. The downside is in the level of resources required to do it well.

One channel that is often overlooked is performance marketing, also known as affiliate marketing. This type of marketing, involves partnering with influencers and websites in personal finance who will promote your bank via articles, reviews and even podcasts — and the best part is, it is on a results basis (cost per acquisition). Tracking is a must for this type of marketing, as compensation for customer referrals happens once a customer becomes a customer.

Five: Take it Step by Step

Like anything, there’s no need to plunge headfirst when it comes to digital marketing — take it one step at a time. Consider how much of your budget is currently allocated to digital marketing and where there is an opportunity to reallocate funds to new tactics.

The majority of the banks that we’ve connected with are only just starting to look at investing in digital. In fact, 80% of them spend less than 20% of their overall budgets on digital tactics. In comparison to other industries making the shift to digital, these banks are trailing behind.

The key is not making a major shift but instead starting small. Focus your efforts on high-priority channels first, then monitor and optimize your efforts continuously. By testing and learning, your strategy will become more refined, and you can identify and focus your efforts on areas that are the most impactful on your bank.

Concluding Remarks

Digital is no longer an option for banks — it is a way to level the playing field, and those that do it smartly will be poised to get ahead of the competition. The five principles above are by no means the only considerations to be made; however, they are helpful pillars to help orient you and your team as you look to shift to more strategic digital tactics.

Remember that what works for one bank may not work for yours, so make sure to give your team space to test and learn. Lastly — don’t forget to have fun! It is an exciting time for many banks to get ahead, and while it can seem like a challenging undertaking, the opportunities in digital are endless. Happy marketing!